Contents:

The foreign exchange, or Forex, is a decentralized marketplace for the trading of the world’s currencies. Suppose also that the next traveler in line has just returned from their European vacation and wants to sell the euros that they have left over. They can sell the euros at the bid price of USD 1.30 and would receive USD 6,500 in exchange for their euros. You can watch the most liquid forex parings to get a sense of what a good spread is in forex. It might also help to compare the spreads between brokerages to ensure you’re getting the best deal. As a result of accepting the risk and facilitating the trade, the market maker retains a part of every trade.

The process of exchanging bid and ask prices on certain assets finally concludes in a price that is acceptable for buyers, as well as sellers. Usually, buyers want as low a price on the asset as possible, while sellers want to get the highest price. Very simple – It is the difference between the bid and the ask price that is called the spread. It’s just like if you were trying to sell your old monitor to a shop that buys used ones.

To chttps://forexdelta.net/ a sell position, you need to open a purchase with the same volume. A stop loss order for a sell trade means a buy trade entered at the Ask price. By extension, the ask is the price at which the market is prepared to sell the asset, and the price at which the trader is able to buy that asset. The bid is defined as the price at which the market is prepared to buy the asset, and the price at which the trader is able to sell that asset.

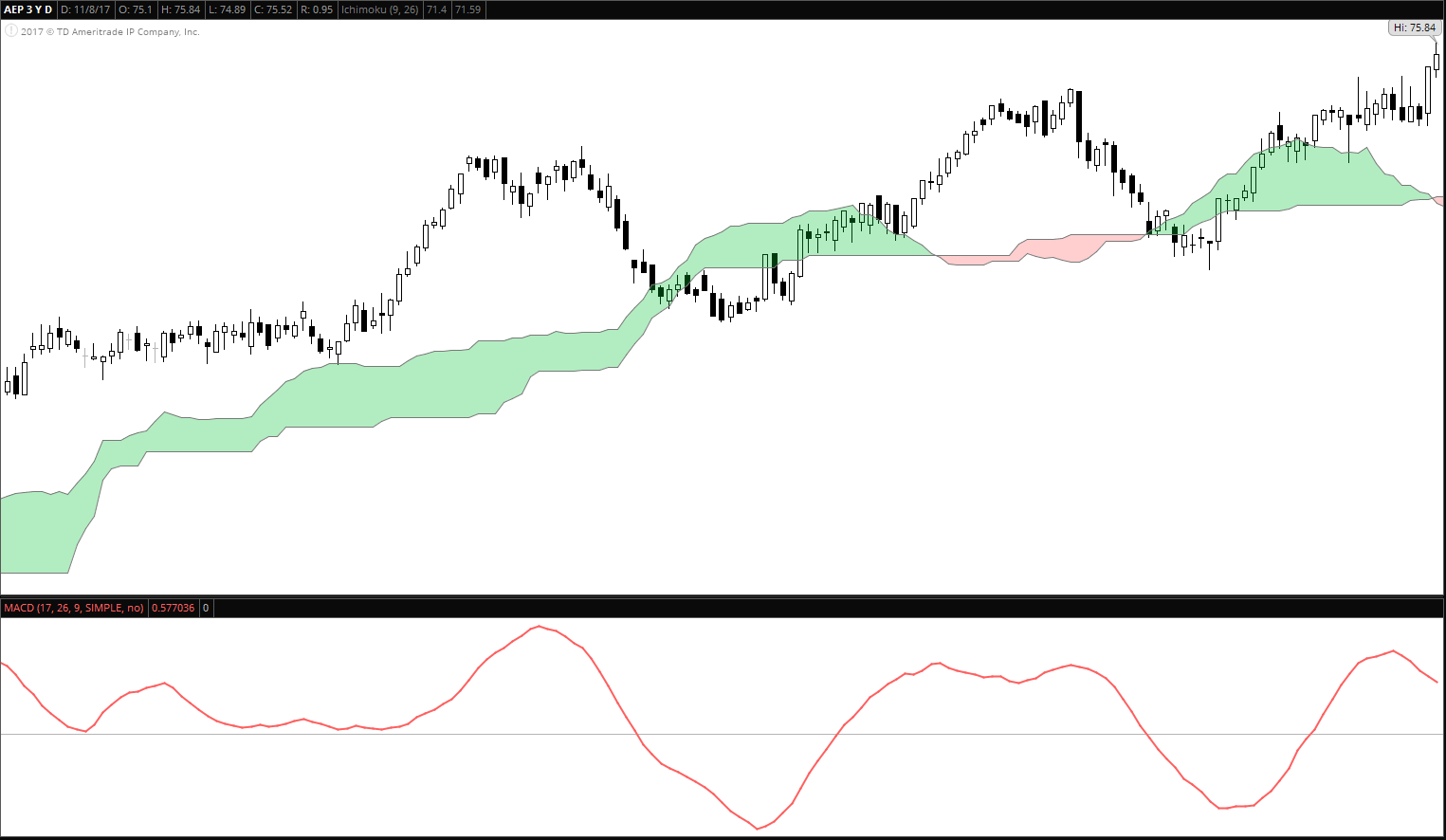

Multiple market makers compete for business when you trade popular currencies, such as the GBP/USD pair. If you trade a thinly traded currency pair, there may be only a few market makers to accept the trade. Reflecting on the lessened competition, they will maintain a wider spread. The table above shows the Bid, Ask and Last prices for four currency pairs on MetaTrader 5. By looking at the Last price, you can see whether the price is being traded on the bid or ask side of the bid-ask spread. The ask and price is a two-way quotation that states the price at which a commodity can be sold or purchased.

Recommendations on trading Bid and Ask in Forex

The current price is constantly fluctuating and is determined by the price at which that asset last traded. Basic economic theory states that the current price is determined where the market forces of supply and demand meet. Fluctuations to either supply or demand cause the current price to rise and fall respectively. This is the bid price or the maximum price at which a buyer is willing to buy an asset. The buyer does not want to buy expensive, this is the logic of the law of supply and demand. Please note that by investing in and/or trading financial instruments, commodities and any other assets, you are taking a high degree of risk and you can lose all your deposited money.

Exinity Limited is a member of Financial Commission, an international organization engaged in a resolution of disputes within the financial services industry in the Forex market. The “bid “represents demand and the “ask” represents supply for an asset. Exchange rates vary by dealer, so it’s important to research the best rate before exchanging any currency. In most cases, the change in value will be slight, and the market maker will still make a profit. Libertex MetaTrader 5 trading platform The latest version of MetaTrader. Libertex MetaTrader 4 trading platform The #1 professional trading platform.

An example is the “https://traderoom.info/ clamp” instituted by Argentina starting in late 2011 to keep U.S. dollars in the country. By the end of 2012, the difference between the official exchange dollar-peso rate and the rate for individuals and businesses to buy dollars with pesos was more than 40 percent. Forex trading is the buying and selling of global currencies. It’s how individuals, businesses, central banks and governments pay for goods and services in other economies.

What’s a good spread in forex?

When traders place market orders, they tell their brokers to execute trades at current prices in the current moment. When it comes to limit orders, limit orders enable traders to buy or sell assets from predetermined levels. The downside of limit orders is that they may never get filled if price does not reach a certain point.

Overall, this study’s evidence indicates that foreign investors, as liquidity providers, can play a positive role in an emerging economy even when FX liquidity declines. Now, let’s talk about the price point which is satisfying for sellers and buyers of these assets. As we mentioned earlier, the bid price is the maximum that a buyer is willing to pay for an asset.

The foreign exchange market – also known as forex or FX – is the world’s most traded market. Both the bid and ask prices are displayed in real-time and are constantly updating. The changing difference between the two prices is a key indicator of the liquidity of the market and the size of the transaction cost. As the current price represents the market value of a financial instrument, the bid and ask prices represent the maximum buying and minimum selling price respectively.

The chart price touches the level where you want to enter a buy trade, but the position doesn’t open and you miss the trend. If a bid is placed with a limit above the current ask market price, it may be immediately executed. If an offer is placed below with a limit below the current bid market rice, it may be immediately executed. Please note that FBS offers tradingaccountswith fixed and with floating spread, so you can choose the option you like best or have several different accounts.

What Are Bid And Ask Price?

Consider using forward currency contracts to lock in exchange rates if you are making sales with long lead times between receiving the order and getting paid in the foreign currency. The trader initiating the transaction is said to demand liquidity, and the other party to the transaction supplies liquidity. Liquidity demanders place market orders and liquidity suppliers place limit orders.

A Basic Guide To Forex Trading – Forbes Advisor INDIA – Forbes

A Basic Guide To Forex Trading – Forbes Advisor INDIA.

Posted: Thu, 21 Apr 2022 07:00:00 GMT [source]

It’s important to keep this in mind if you plan on trading during this three hour window. In fact as a general rule you should always check the bid ask spread before entering a trade regardless of the current trading session. Liquidity describes the extent to which an asset can be bought and sold quickly, and at stable prices, and converted to cash. Liquidity refers to how quickly and at what cost one can sell an asset,… When you calculate a currency rate, you can also establish the spread, or the difference between the bid and ask price for a currency. If you decide to make the transaction, you can shop around for the best rate.

As you already know, currency pairs in the foreign exchange market are always made up of the base currency and the quote currency, such as GBP/NZD or USD/GBP. The reason they are quoted in pairs is that in every foreign exchange currency pair transaction, traders simultaneously buy one currency and sell another. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

You can use a limit price to get a better price, but doing so may mean you miss a trade if the price moves away from you. A market order will ensure that you don’t miss an opportunity, but your execution price won’t be as good. A limit order is placed in the market at the limit price and can only be executed at the limit price or better. All visible bid and ask prices in the market are limit orders. A lot is either 1000, 10,000, or 100,000 worth of currency, called micro, mini, and standard lots respectively.

Identify your strengths and weakness as a trader with cutting-edge behavioural science technology – powered by Chasing Returns. Trade thousands of markets including Luft, EUR/USD, Germany 40, and gold. Commissions from 0.08% on global shares & extended hours on 70+ stocks. Now, there’s other advantages to trading the higher timeframes.

These changes will have profound effects on exchange rate dynamics. Looking forward, we highlight fundamental yet unanswered questions on the nature of private information, the impact on market liquidity, and the changing process of price discovery. We also outline potential microstructure explanations for long-standing exchange rate puzzles. This paper studies short-term liquidity withdrawal in the FX spot market for eight currency pairs.

Since brokerage commissions do not vary with the time taken to complete a transaction, differences in bid–ask spread indicate differences in the liquidity cost. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. I find that spreads widen with proxies for inventory-carrying costs, including forecasts of price risk and a measure of liquidity costs. Increases in spreads before nontrading periods can also be attributed to inventory costs.

Furthermore, we analyze whether and how liquidity begets price efficiency by looking at violations of the “triangular” no-arbitrage condition. We find that dollar-based currencies offer a lower trading impact supporting price efficiency. The bid-offer spread is essential in trading as it shows the difference between the ask and bid price. The market maker profits from the spread and the transaction cost. The trader should take into account the bid ask spread so that he/she can use pending orders and enter trades at the most favourable prices. If you understand bid price vs ask price and consider the bid ask spread, you will avoid the traps covered in the article and increase the potential profits.

- With some currencies, a 5 percent spread may turn out to be a good deal.

- In the trading process, sellers and buyers seek to offer each other the most favourable prices for a trade so as to make a profit.

- Almost all currencies are quoted to four decimal places except the Japanese Yen, usually quoted to two decimal places.

- 89.1% of retail investor accounts lose money when trading CFDs with this provider.

Bids on the left, asks on the right, with a bid–ask spread in the middle. It may help you to think of the base currency as a commodity being traded. The market maker will want to buy the commodity at the lowest price possible and sell the commodity at the highest price possible.

If several sellers have limited orders in the market, the order with the lowest price will show as the market’s ask price. Stocks with high volume tend to have smaller bid-ask spreads. The x-axis is the unit price, the y-axis is cumulative order depth.

Dealer Type

The https://forexhero.info/ wants to buy cheaper, and the seller wants to get a higher price. As described above, the bid-ask spread is the difference between the buy price and sell price. For example, if the market price of an asset is $40, the bid price might be $41 and the ask price $39. Bid and offers are placed in the market depth and are visible by internal marketplace participants.

If you haven’t had the time to shop around for the best rates, research ahead of time so you have an idea of the spot exchange rate and understand the spread. If the spread is too wide, consider taking your business to another dealer. A direct currency quote, also known as a “price quotation,” is one that expresses the price of a unit of foreign currency in terms of the domestic currency. An indirect currency quote, also known as a “volume quotation,” is the opposite of a direct quote.